The net inflow into spot ETFs based on Bitcoin and Ethereum has nearly reached $527 million

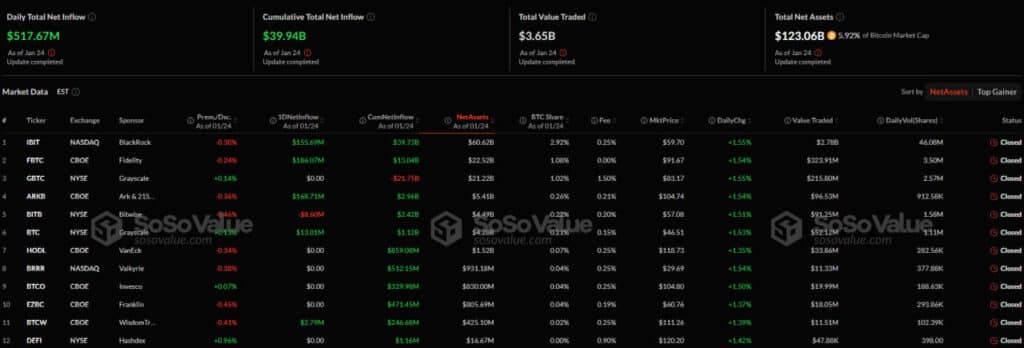

On January 24, 2024, spot Bitcoin and Ethereum ETFs recorded a net inflow of $526.85 million. The majority of the capital was allocated to Bitcoin-based funds, totaling $517.7 million, according to data from SoSoValue.

The leading fund in terms of capital inflow was Fidelity Investments’ spot Bitcoin ETF, trading under the ticker FBTC. It reported $186.1 million in inflows, with its assets under management (AUM) reaching $22.52 billion.

The second spot was taken by the crypto fund from Ark Invest and 21Shares. The spot Bitcoin ETF, tickered ARKB, attracted $168.7 million in inflows, bringing its AUM to $5.41 billion.

BlackRock’s crypto fund (IBIT) ranked third in inflows, recording $155.7 million. Despite this, the product remains the leader in total assets under management, with an AUM of $60.62 billion.

Additionally, other spot Bitcoin ETFs received capital inflows, including Grayscale Investments’ BTC fund ($13 million) and WisdomTree Investments’ BTCW fund ($2.8 million).

The only fund to record an outflow was Bitwise Asset Management’s BITB ETF, which lost $8.6 million over the past day. The remaining six Bitcoin-based investment products ended the day with zero inflow or outflow activity.

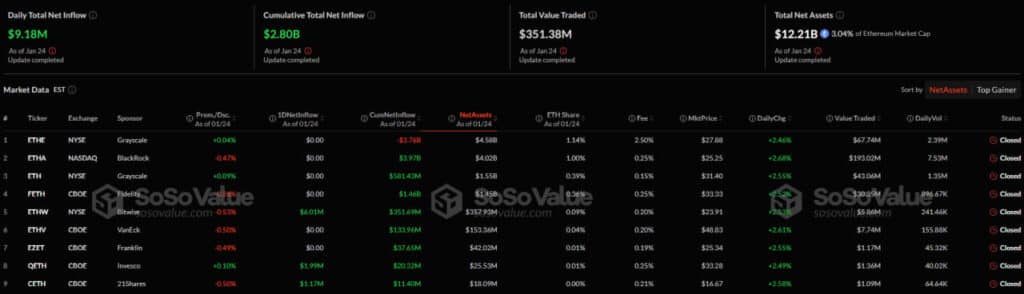

As for the Ethereum ETF segment, it saw inflows totaling $9.2 million. Leading this category was Bitwise’s ETHW ETF, which recorded $6 million in inflows.

The second position went to the ETF from Invesco and Galaxy Digital, trading under the ticker QETH, which gained $2 million.

Rounding out the top three was 21Shares’ spot Ethereum ETF, tickered CETH, which reported $1.2 million in inflows. The other six Ethereum-based investment products did not show any asset movement during the previous trading day.